are new hampshire property taxes high

Current Use Taxes. Account number parcel number or address and pay property taxes online.

Mark Fernald Why Your Property Taxes Are So High

Michigan is ranked 10th of the 50 states for property taxes as a percentage of median income.

. Other states like New Jersey and Illinois impose high property taxes alongside high rates in the other major tax categories. Census Bureau and residents of the 27 states with vehicle property taxes shell out another 445. Eastern White Pine Management Institute.

In calendar year 2019 the most recent data available New Jersey had the highest effective rate on owner-occupied property at 213 percent followed by Illinois 197 percent and New Hampshire 189 percent. Depending on where you live property taxes can be a small inconvenience or a major burden. Search San Juan County property tax.

The Massachusetts Fiscal Alliance which favors reductions in tax rates said Tuesday that relatively high property taxes in Massachusetts combined with high inflation and a proposed surtax on household income above 1 million. New Hampshire scores in the top 11 states on Gallups Well-Being Index. A conference committee of the NH.

We visit your property free of charge and help you achieve your woodlot objectives including forestry recreation wildlife habitat water resources scenic beauty and income. Census Bureau American Community Survey 2006-2010. Legislature approved a bill Wednesday that would cut the business profits tax from 76 percent to 75 percent and provide a one-time payment to cover 75 percent.

The state does have a 5 percent tax on dividends and interest that is above 2400 per person and property taxes are among the highest in the country. Most of the duties of the tax collector are specified by New Hampshire state law RSAs under Title V. Property Search and GIS Maps.

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. The exact property tax levied depends on the county in Michigan the property is located in. One reason property taxes are so high is that the state of New Hampshire collects a statewide property tax in addition to the local taxes that cities counties and school districts collect.

74 High Street Candia NH 03034. Some states have notoriously high property tax rates New Jersey Illinois and New Hampshire are all up there while other states are known for their low property tax rates Louisiana Hawaii. 220000 New assessed value of the property-20000 Portion of assessed value exempt from property taxes 200000 New assessed value of the property w the renewable energy exemption.

Thirty-eight states collect sales tax at both the state and local levels as of 2022. Main Level of Town Hall 12 School Street Hudson NH 03051 Phone. Only Connecticut Delaware Indiana Kentucky Maine Maryland Massachusetts Michigan Montana New Hampshire Oregon Rhode Island and the District of Columbia do not permit local sales taxes.

A combination of high property tax rates and high home values in northeast New Jerseys Bergen County means that the median property tax bill is more than 10000 the highest the US. Connecticut Vermont and New Hampshire are also among the least competitive property taxes By Michael Norton. The state of New Hampshire has a number of top rated hospitals.

About Assessor and Property Tax Records in New Mexico. See the NH cities and towns that have adopted one or more renewable energy property tax exemptions based on data from the NH Department of Revenue Administration. Of the New England states only Maine and Rhode Island have better property tax rates.

San Juan County Free Search. Connecticuts is the worst in the nation followed by. When you start paying property taxes on a new home is largely the same whether you move into a previously owned home or a new construction home.

Combined State and Local Taxes. Cibola County Assessor 515 West High St Grants NM 87020 Phone 505 285-2526 Fax 505 285-5434. That is more than twice the national average.

Thats tied for the highest figure of any county in the state and its almost five times the national average. Town Directory Contacts. 603 598-6481 Office Hours Monday - Friday 800am - 430pm.

Washtenaw County collects the highest property tax in Michigan levying an average of 181 of median home value yearly in property taxes while Luce County. Pay your property taxes online. Those duties include but are not limited to the following.

The average American household spends 2471 on property taxes for their homes each year according to the US. University of New Hampshire Extension 877 398-4769.

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

States With The Highest Property Taxes Gobankingrates

Historical New Hampshire Tax Policy Information Ballotpedia

New Hampshire Retirement Tax Friendliness Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

Mark Fernald Why Your Property Taxes Are So High

Mark Fernald Why Your Property Taxes Are So High

Mark Fernald Why Your Property Taxes Are So High

Property Taxes By State County Lowest Property Taxes In The Us Mapped

New Hampshire Property Tax Calculator Smartasset

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Understanding New Hampshire Taxes Free State Project

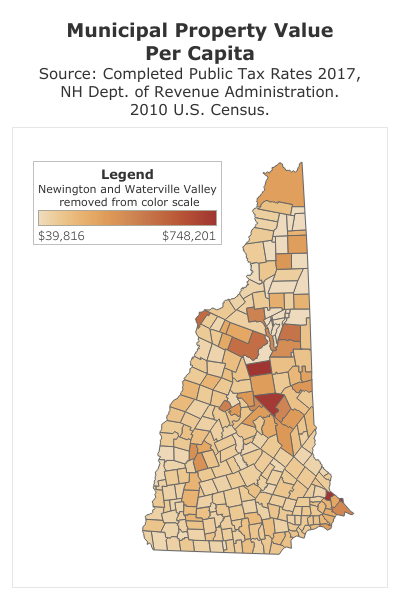

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute

States With The Highest And Lowest Property Taxes Property Tax States Tax

New Hampshire Property Tax Calculator Smartasset

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)